Dexus: Q1 2020 Australian Real Estate Review

Office

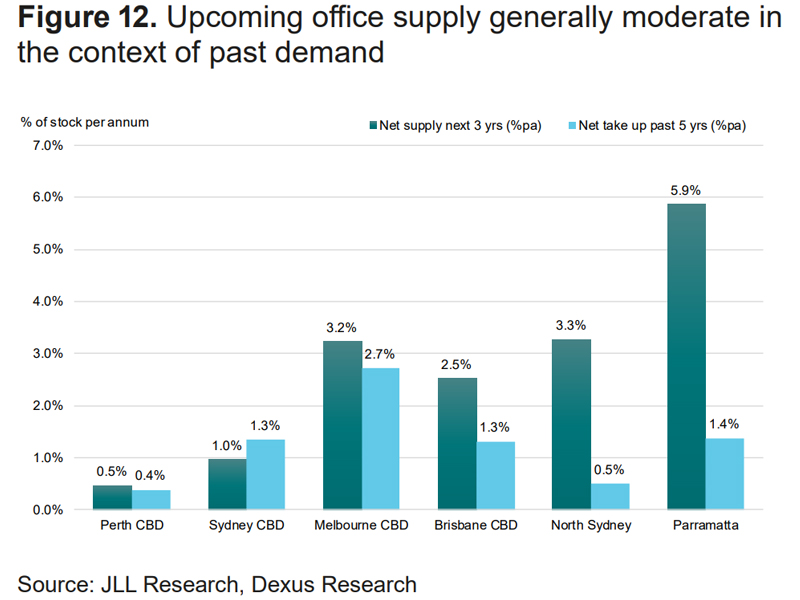

Business conditions in office-using industries such as finance and professional services remain above the all-industry average as office markets recorded a positive rent growth in the 12 months to December, providing Australian office markets with a degree of resilience in a period of uncertainty. Due to the decentralization of several Government departments and consolidation by Telsra out of 231 Elizabeth Street, Sydney CBD recorded negative net absorption of 37,700sqm in the first half of FY20. Disregarding these events, net absorption was close to zero reflecting a shortage of available prime space.

Business confidence in NSW remains higher than the national average. Appetite for Sydney CBD office assets remains strong due to low interest rates. Prime investment yields fell a further 25 basis points in 2019 to a record low of 4.5%.

Investment climate

The growth of Australian GDP moderated over the past year and is forecast to remain at around 1.8% per annum in FY20 before improving FY21. The overall economic impact of Australia’s bushfire is likely to be small with Goldman Sachs estimating a 0.3 basis points hit in the short term followed by a boost in growth from rebuilding despite it being expected to have major environmental and social impact, and most likely to contribute in a hiatus of tourism.

Transactions

Office continues to be the most active sector in transaction activity - which has sustained its positive momentum with 2019 volumes reaching a record high of $34b, accounting for two thirds of total volumes.

Spotlight

The Coworking sector – which has been a major part of office demand accounting for 18% of CBD office take up nationally over the past five years, is growing its share of total office stock but at around 3% of Sydney CBD market; still at low levels by international standards. Coworking may compete with traditional office at the smaller end of the market as it compliments traditional office space by allowing businesses to expand or contract on a short term basis by acting as an incubator for traditional office space when occupiers outgrow their coworking space.

Article and image source: Dexus Australian Real Estate Quarterly Review Q1 2020

Ray White’s weekly top 5 listings: (Click on the address to view listing)

Whole Level 2/122 Pitt Street SYDNEY

Part Level 4/31 Market Street SYDNEY

Level 1/36 Gosbell Street PADDINGTON

Level 5/130 Harris Street PYRMONT

Level 4/447 Kent Street SYDNEY